Measure ULA asks voters to fund homelessness and housing affordability efforts by approving a new tax on property sales in Los Angeles. But the tax would not apply to the average L.A. home. It would only apply to some of the most valuable real estate in the city: properties worth $5 million or more. That’s where the nickname among supporters, the “mansion tax,” comes from.

Official title on the ballot: Funding affordable housing and tenant assistance programs through a property transfer tax

Shall an ordinance be adopted to add a tax on the sale or transfer of real property valued at over $5 million to fund affordable housing and tenant assistance programs?

WHAT YOUR VOTE MEANS

A "yes" vote means:

- You want to levy a new tax on the sale of properties valued at $5 million or more in order to fund affordable housing and homelessness programs.

A "no" vote means:

- You do NOT want to impose a new tax property sales of $5 million or more in order to fund affordable housing and homelessness programs. You want the city to use only preexisting funds instead.

Understanding The Measure

The city of L.A. already imposes what’s called a “documentary transfer” tax on property sales. Measure ULA would significantly increase those taxes for top-dollar deals. Property sales between $5 and $10 million would be subject to a 4% tax rate, while deals worth $10 million or more would be taxed at a higher rate of 5.5%. The threshold determining which properties are subject to the tax would be adjusted each year based on inflation.

More Voter Guides

How to evaluate judges

- Superior Court: What you need to know to make a choice

- Courts of Appeal: Why this in on your ballot

- State Supreme Court: What your vote means

Head to LAist's Voter Game Plan for guides to the rest of your ballot including:

- Statewide propositions: 26 and 27 (sports betting ballot measures), 29 (kidney dialysis) and more.

- L.A. City: mayor and city council races and Measure LH

- L.A. County: Sheriff, supervisor races and Measure C

According to estimates from the city’s chief legislative analyst, Measure ULA would raise anywhere from $600 million to $1.1 billion per year. The plan is to spend Measure ULA revenue on affordable housing creation and tenant aid for preventing homelessness.

Supporters have said the measure could produce 26,000 new homes over a 10-year period through strategies such as repurposing existing buildings (think underused motels). Other funding would go toward targeted rental assistance, tenant eviction defense and the creation of a Tenant Council to advise the city on renter protections.

UCLA policy researchers and Measure ULA supporters have said that if the tax existed in recent years, only the top 3% of home and condo sales would have been affected. Certain housing organizations, nonprofits and government entities would be exempt from the tax.

The History Behind It

Some context: On any given night, about 42,000 people are experiencing homelessness in the city according to the region’s latest homeless count. Homelessness in L.A. has increased by about 41% since 2013.

However, there are some signs that the number of unhoused L.A. residents stabilized during the pandemic. Homelessness in the city increased by just 1.7% between 2020 and 2022. Housing policy experts credit temporary eviction protections and rent relief funding with preventing many low-income tenants from falling into homelessness during the pandemic.

Measure ULA supporters say their proposed tax will build on lessons learned during the pandemic by expanding efforts to prevent cases of homelessness before they even begin.

Opponents of Measure ULA question the need for another tax to increase local homelessness funding. Voters approved Measure HHH (a $1.2 billion bond measure to fund 10,000 new units of permanent supportive housing in the city of L.A.) and Measure H (an L.A. County sales tax increase to fund homeless services) in 2016 and 2017, respectively. Measure ULA skeptics say those existing funds could be better spent on tackling homelessness first, before additional taxes are imposed.

In May, Ryan Ole Hass, former president of the Greater Los Angeles Association of Realtors, told LAist, “We're just concerned that another tax — levied on whatever class of owner — is not going to fix the problem… Why don't we look at what we've raised before and say, 'OK, how can we take the money we have and make it effective?'”

Public skepticism about the success of previous homelessness funding measures may help explain why neither Rick Caruso nor Karen Bass have expressed support for Measure ULA during their campaigns for L.A. mayor.

Due to recent state Supreme Court decisions clarifying that the public can pass new taxes through a simple majority vote, Measure ULA only needs to clear 50% voter support to take effect, rather than the two-thirds threshold state lawmakers need to surpass to raise taxes under California law.

Arguments For

Measure ULA is backed by groups including homeless service providers, labor unions, renters rights groups and affordable housing developers. In their official L.A. voter guide argument in favor of the measure, supporters write, “Millionaires and billionaires cashing in on mega properties can afford to pay the ‘mansion tax,’ and we’ll all benefit from reduced homelessness when they chip in and pay their fair share.”

Implementation of Measure ULA will be overseen by an appointed “Citizen Oversight Committee.” Although critics point to this as a body of unelected and unaccountable bureaucrats, supporters say the committee’s independence is a strength.

They write, “Unlike past efforts, this measure would create sustained funding to reduce homelessness with oversight from an independent board of homelessness and housing experts and a dedicated inspector general. No politician who currently holds elected office will be allowed on the board.”

Arguments Against

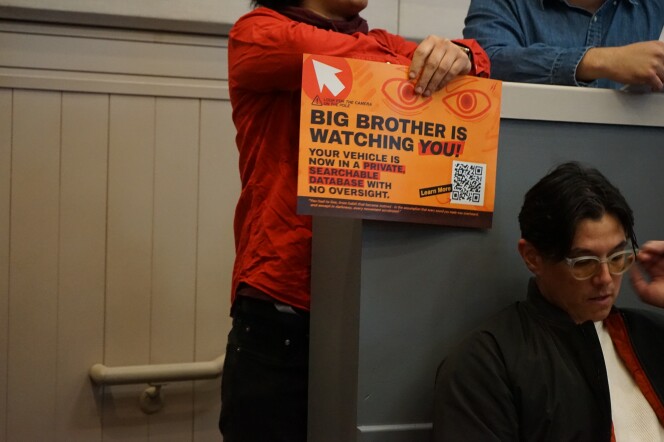

Opponents to Measure ULA include the L.A. County Business Federation, the Howard Jarvis Taxpayers Association, L.A. real estate agents and a local landlord group called the Apartment Association of Greater Los Angeles.

They argue that although the tax will only be levied on properties worth $5 million or more, the cost will ultimately be paid by ordinary L.A. residents. They say when apartment buildings sell for more than $5 million, landlords will pass the cost of the new tax on to tenants through higher rents. Owners of grocery stores and other retail centers subject to the tax will raise prices for consumers, they say.

“The cost of living in L.A. is already too high, and Initiative Ordinance ULA will lead to higher prices for consumers,” opponents write in their official argument in the city’s voter guide.

However, UCLA policy researchers dispute this claim, saying transfer taxes levied on property sales are unlikely to trickle down to consumers. In a September analysis of Measure ULA, they write, “There is no evidence that the tax would impact rents for commercial or residential tenants. In most cases, transfer taxes are paid by the seller, who will have no legal avenues to pass on costs to tenants in a building which they no longer own. Additionally, this report cites multiple studies which show that rents are determined by the market, not taxes and fees.”

Potential Financial Impact

The city administrative officer's financial impact statement offers additional detail about how the tax rate will be set. They estimate between $600 million and $1.1 billion in revenue from the tax.

This measure establishes a special tax within the City of Los Angeles, imposed on all property types valued at $5,000,000 or more when sold or when legal ownership is transferred, to fund affordable housing and tenant assistance programs. Certain affordable housing organizations may qualify for an exemption. The tax rate is determined by the property value at the time of sale or transfer: 4.0 percent tax rate for values of $5,000,000 through $9,999,999, and 5.5 percent for values of $10,000,000 or greater. The value thresholds adjust annually, based on the Consumer Price Index. The special tax imposed is in addition to the existing 0.56 percent combined City and County tax rate on property sales and transfers.

Annual revenue from the special tax, estimated between $600 million and $1.1 billion, will fluctuate according to the respective number of property sales and transfers with values above $5 million and $10 million.

Further Reading

- L.A. Homelessness Initiative Supporters Say They Have Enough Signatures To Qualify For November Ballot (LAist)

- L.A. to vote on ‘mansion tax’ to raise money for housing. Bass, Caruso don’t support it (Los Angeles Times)

- Will L.A. Voters Choose To Tax All Property Sales Over $5 Million To Fund Affordable Housing This Fall? (L.A. Taco)

- The full report on Measure ULA from the city clerk

More Voter Guides

City of Los Angeles

- Mayor: Learn more about Karen Bass and Rick Caruso, and who is funding their campaigns

- City Controller: Learn who is running and why it matters

- Measures: Make sense of Measure LH, Measure SP, and Measure ULA

- City Council: There are four districts on this ballot

L.A. County

- Sheriff: Compare the two candidates for L.A. County sheriff

- Water Agencies: Learn what they do and what to look for in a candidate

How to evaluate judges

- Superior Court: What you need to know to make a choice

- Court of Appeals: Why this in on your ballot

- State Supreme Court: What your vote means

California propositions

- Propositions 26 and 27: The difference between the sports betting ballot measures

- Proposition 29: Why kidney dialysis is on your ballot for the third time

- Proposition 30: Why Lyft is the biggest funder of this ballot measure

Head to the Voter Game Plan homepage for guides to the rest of your ballot.