Topline:

A new report from L.A. County offers a closer look at the economic damage to the region caused by federal immigration enforcement — and at the neighborhoods most affected.

Where is the report from? The analysis was compiled by the Los Angeles County Department of Economic Opportunity and Los Angeles County Economic Development Corporation. The report lays out the ripple effect of that campaign on communities, local businesses, and workers, and its uneven influence on the region as a whole.

What were some of the findings? Researchers determined that the most targeted ZIP code in the county is 91402, which spans Mission Hills, Panorama City and North Hills in the San Fernando Valley.

Background: The Department of Homeland Security has detained more than 10,000 people in the L.A.-area since June, according to numbers released in December. Its aggressive deportation campaign has altered daily life in Los Angeles, where nearly one in five people is undocumented or lives with someone who is undocumented.

Read on… for how small businesses have experienced in the wake of the ongoing ICE raids.

A new report from L.A. County offers a closer look at the economic damage to the region caused by federal immigration enforcement — and at the neighborhoods most affected.

The analysis, compiled by the Los Angeles County Department of Economic Opportunity and Los Angeles County Economic Development Corporation, identified the neighborhoods hardest hit by ICE, and found that they were more economically precarious.

Researchers determined that the most targeted ZIP code in the county is 91402, which spans Mission Hills, Panorama City and North Hills in the San Fernando Valley.

The report, which was commissioned by the county Board of Supervisors, also found that many small businesses county-wide have lost revenue and customers since ICE ramped up its presence in Los Angeles last year.

The Department of Homeland Security has detained more than 10,000 people in the L.A.-area since June, according to numbers released in December. Its aggressive deportation campaign has altered daily life in Los Angeles, where nearly one in five people is undocumented or lives with someone who is undocumented.

The report lays out the ripple effect of that campaign on communities, local businesses, and workers, and its uneven influence on the region as a whole.

Vulnerable neighborhoods

The report lays out the economic consequences for communities repeatedly hit by ICE sweeps.

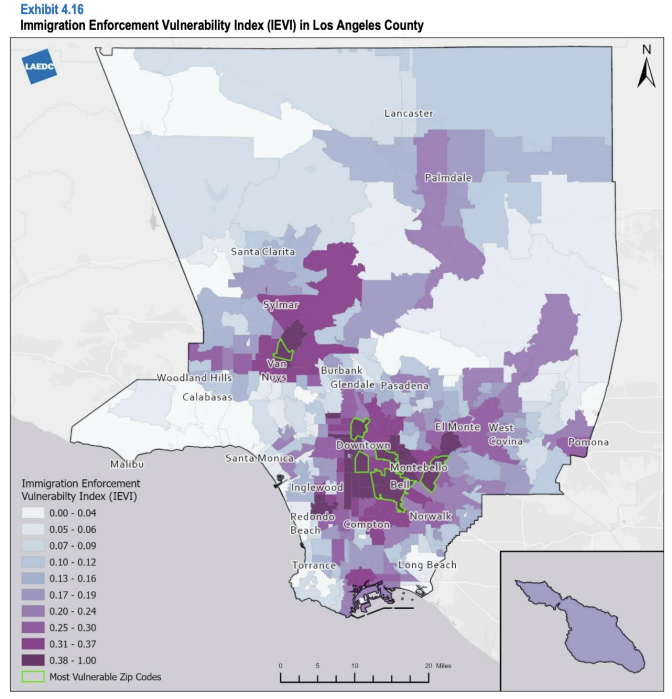

The Los Angeles County Economic Development Corporation, a nonprofit research group, used census data and reports on detentions from the Los Angeles Rapid Response Network to assess how vulnerable each L.A. County ZIP code was to immigration enforcement.

Researchers looked at four other factors for each ZIP code: shares of foreign-born population from Latin America, renter households, Spanish-speaking households and non-citizen workforce.

The 10 most vulnerable ZIP codes, they determined, are primarily in working class, immigrant neighborhoods including Bell, Pico Rivera and Southeast L.A.

Researchers used employment data for the county and found that those ZIP codes were over-represented in industries, including manufacturing and retail, which have a significant number of undocumented workers. Businesses in these neighborhoods also tended to have fewer employees on average compared to the rest of the county, and employees were paid less.

"Taken together, these exhibits show that areas facing heightened immigration enforcement differ from the rest of Los Angeles County and appear more economically vulnerable," the report states.

Declined revenue, less foot traffic

Researchers also distributed a survey to small businesses county-wide to assess how federal immigration enforcement has affected the communities they operate in and their bottom lines since summer.

More than 200 small businesses responded. Most reported having fewer than 10 employees, and the majority were in industries like restaurants, retail, professional or personal services and manufacturing.

The majority of respondents — 82% — reported being negatively affected by federal immigration enforcement. Around half reported lost regular customers, less foot traffic or reduced daily sales. Around a quarter reported temporary closures due to concerns from community members.

Many surveyed business owners reported a climate of fear that has led people to stay home and avoid certain places altogether.

"Businesses reported that customers expressed fear about their location, that customers asked about safety in the neighborhood, and that customers avoided shopping or dining in their neighborhood," the report states.

Undocumented workers generate 17% of county's economic activity

No corner of Los Angeles is exempt to the ongoing immigration sweeps that have become a new reality for the region. Nearly 950,000 undocumented immigrants live in L.A. County, according to recent estimates. That's more than 9% of people in the county who lack legal status.

Undocumented workers also play a huge role in many of L.A.'s key industries. Recent research from the USC Equity Research Institute estimates that 37% of cleaning and maintenance workers and 25% of food preparation and service workers in L.A. County are undocumented.

The industry with the highest percentage of undocumented workers is construction, at 40%.

The county's undocumented population together generates just under $240 billion in economic output, according to the county's report. That's around 17% of the county's total economic activity.