It’s been two weeks since Tesla introduced its all-electric Model 3 sedan, with a range of 215 miles per charge and a starting price of $35,000. Costing half as much as the auto maker’s larger Model S, the Model 3 surprised industry analysts when more than 325,000 people placed deposits on the compact luxury sedan in little more than a week.

Yet many of those wannabe Model 3 owners who’ve put down $1,000 refundable deposits are expecting to get the car for a whole lot less. At least $7,500 less, courtesy of federal government incentives for all-electric vehicles.

That subsidy only exists to a certain point, however. The federal tax credit phases out once a manufacturer has sold 200,000 electric vehicles in the U.S. — a target Tesla is projected to hit in early 2018, soon after the Model 3 is scheduled to go into production. General Motors, which sells the plug-in hybrid Volt, all-electric Spark and upcoming long-range all-electric Bolt, will also be among the first auto makers to hit the 200,000 EV mark that triggers reduced tax incentives.

It was the Energy Improvement and Extension Act of 2008 that established tax credits for plug-in electric vehicles as a means of spurring buy-in of more fuel efficient cars and stimulating the economy. Effective for new cars purchased in or after 2010, when the Chevrolet Volt and Nissan Leaf ushered in a new era of plug-in electric vehicles, the tax credits range from $2,500 to $7,500 per car, based on battery capacity.

Electric vehicles with larger batteries, such as the Tesla Model S and BMW i3, are eligible for the largest, $7,500 rebate, while EVs with less all-electric range, such as the Toyota Prius Plug-in Hybrid, receive as little as $2,500 from the federal government.

The EV credit is processed with Internal Revenue Service Form 8936, aka the Qualified Plug-in Electric Drive Motor Vehicle Credit. For a hydrogen fuel cell electric vehicle, it’s Form 8910. Both forms are filed along with the IRS Individual Income Tax Return Form 1040. The tax credit operates as a dollar-for-dollar credit against taxes owed.

Paired with state incentives, such as California’s Clean Vehicle Rebate Project, which refunds buyers $1,500 for new plug-in hybrids, $2,500 for all-electric vehicles and $5,000 for hydrogen fuel cell vehicles, the cost of the most popular EVs are often reduced by $10,000 off the manufacturer’s suggested retail price.

The $35,000 Tesla Model 3, for instance, could be had for as little as $25,000 after applying the California Clean Vehicle Project rebate and federal tax credit, bringing Tesla’s entry-level model down to a price that falls between bestselling, similarly sized gas-powered cars like the Honda Ciivc (starting at $19,475) and BMW 3 Series (starting at $34,145).

It’s no wonder so many people have plunked down a deposit to buy the Model 3. It’s entry-level luxury at a more mainstream price. Yet once an auto maker sells 200,000 electric vehicles in the U.S., the federal tax credit begins to phase out. At the end of the quarter following the fiscal quarter during which the company hits its 200,000-vehicle production limit, the IRS reduces the $7,500 credit to $3,750 for the following two quarters, and reduces it again to $1,875 for the subsequent two quarters before eliminating the credit altogether.

Depending on Tesla’s production schedule, customers who are early in the delivery queue for the Model 3 are likely to receive the $7,500 federal tax credit, but those who receive their cars later may only get $3,750, $1,875 or nothing at all.

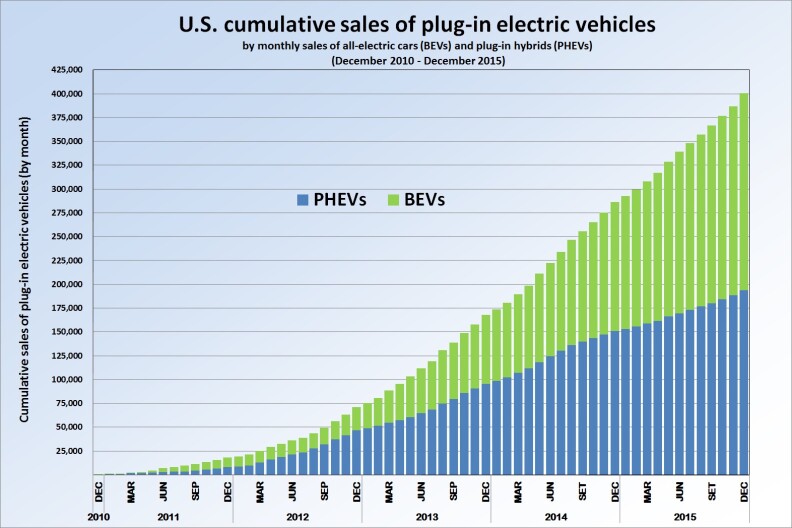

Tesla has so far delivered about 71,000 cars in the U.S., according to the web site InsideEVs.com, and its Model S is currently the nation’s bestselling EV. The Palo Alto-based company is on track to sell at least 70,000 more vehicles in the U.S. by the end of 2017, when Tesla has said the Model 3 will go into production. That means that Tesla will be rapidly approaching its 200,000-car threshold shortly after the Model 3 goes on sale.

“We are committed to providing customers with up-to-date information about current incentives at the time of purchase,” Tesla spokeswoman Alexis Georgeson told Automotive News this week. “We’ll do the same when it’s time for customers to confirm their Model 3 orders.”

General Motors and Nissan, which, as of March 2016, have so far sold 92,737 Volts and 95,522 Leafs in the U.S. respectively, according to InsideEVs.com, will also be among the first auto makers to hit the 200,000-vehicle production limit within the next couple years, at which point their EVs will also be subject to reduced federal tax credits.