Truth matters. Community matters. Your support makes both possible. LAist is one of the few places where news remains independent and free from political and corporate influence. Stand up for truth and for LAist. Make your year-end tax-deductible gift now.

This archival content was originally written for and published on KPCC.org. Keep in mind that links and images may no longer work — and references may be outdated.

This program helps low-income residents. Most don't know about it

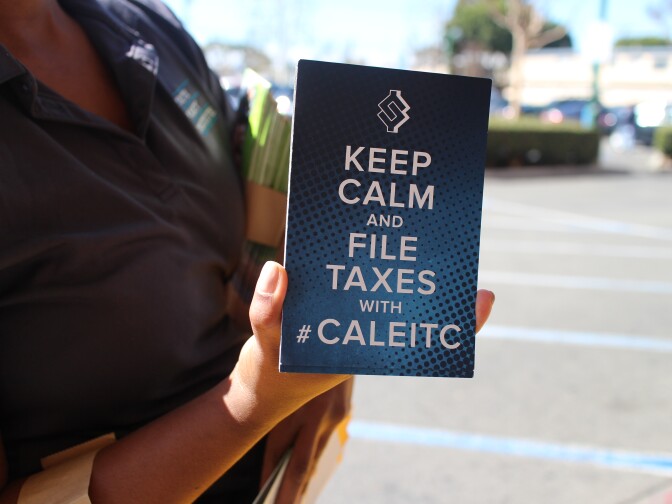

Many shoppers at the Northgate Market in Culver City looked away and shuffled past Matthew Fontana as he smiled and extended his arm, a pamphlet in hand.

"Free money, sir!" was one opener he tried.

"Do you have time to talk about your taxes?" was another.

A few stopped and within an hour, he and his colleague handed out over 100 brochures with information about the California Earned Income Tax Credit (CalEITC). The refundable tax credit, which went into effect in the state in 2016, is supposed to give a boost to individuals and families with low incomes.

"The biggest problem with this program," Fontana said, "is that most people who qualify for it, don’t know that it exists."

As a "promotor" with the Youth Policy Institute, an organization dedicated to breaking the cycle of poverty, Fontana is tasked with getting the word out – something that many agencies, as well as state and local officials want to do.

On Monday, Gov. Jerry Brown issued a proclamation declaring Feb. 11-17, 2018 California Earned Income Tax Credit Awareness Week. “This week, we recognize the importance of the Earned Income Tax Credit and encourage all Californians to spread the word about this important resource to those who need it the most," the proclamation read. "We want every hard-working California family who earned this money to apply for it.”

This is the third tax season of the state program. In the first two years of the program, nearly 400,000 Californians received refunds each year, totaling $200 million. But many more are eligible. According to a survey from the California Budget and Policy Center, only one in five eligible had even heard of it. Many with low earnings don’t actually file taxes.

The fairly new state tax credit is modeled after the federal EITC program, which was enacted in 1975. When low-income residents use both, it can put a lot of cash back in their pockets. A single mom with two kids with earnings just under the poverty line, $19,748, would get $75 in the CalEITC and more than $5,000 in the federal EITC. A single mom living at 50 percent of the poverty line, earning $9,874, would get over $1,500 in the CalEITC and close to $4,000 from the federal program.

"The whole credit is designed to encourage and reward work, because the more you work and the more you earn, the larger credit you can receive," said Alissa Anderson, senior policy analyst at the California Budget and Policy Center.

Do you qualify? Here's an interactive tool to help you estimate your return.

Even more residents are eligible this year. California’s 2017-18 budget agreement raised the income eligibility limits and allowed low-earning, self-employed workers to qualify.

Research on the long-standing federal program shows the tax credit can make a difference.

“That research shows that the credit significantly cuts poverty,” said Anderson. “It also has been shown to significantly boost employment – particularly among single mothers, because single mothers are the largest beneficiary of the credit.”

That's why so many state organizations are trying to get the word out -- just check out #CalEITCAwarenessWeek on Twitter. YPI aims to reach 100,000 residents through their canvassing of shopping markets, WIC centers, libraries and presentations at schools. This tax season and last, the state budget included $2 million in grant funding to support this type of community outreach. The January budget proposal does not continue that funding. Advocates are pushing for that funding to continue and for an analysis to determine the effectiveness of the various forms of outreach.