This story is free to read because readers choose to support LAist. If you find value in independent local reporting, make a donation to power our newsroom today.

This archival content was originally written for and published on KPCC.org. Keep in mind that links and images may no longer work — and references may be outdated.

Arcadia company's virtual currency GemCoin a scam, immigrants say

State officials are investigating an Arcadia company that markets virtual currency similar to Bitcoin. The product was marketed heavily to Chinese immigrants, and now some of them are planning to sue.

The company is called US Fine Investment Arts, Inc., or USFIA. It bills itself as a gemstone mining and sales company. But it also markets a product called "GemCoin," described as the world’s first virtual currency backed by the value of gemstones.

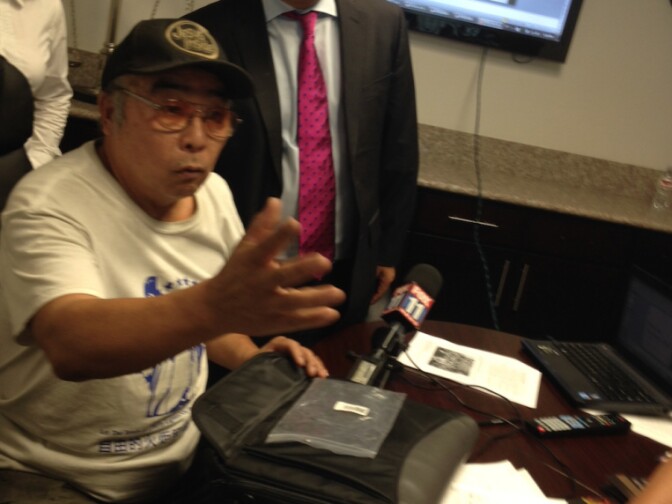

Local Chinese immigrants who invested in the product say they were taken. Among them is 71-year-old George Mo, a security guard from West Covina who said he lost $10,000 — his life savings.

Speaking through a translator in Mandarin this week, he said he was promised a return rate worth at least 64 times his investment. But he received nothing, save for a bag of amber stones worth about $70.

Mo's attorney, Long Liu, said he plans to file a class-action complaint next month. He estimates there are about 3,000 local investors who lost money on GemCoin. He said some, like Mo, were older people who spent their savings.

"They thought that it was a great opportunity, that they can make some money and they can have a great retirement life," said Liu, who is based in San Gabriel. "What happened is they have lost their money, and they are going to have trouble putting food on the table."

US Fine Investment Arts responded to interview requests Thursday afternoon, by email, with a bullet-pointed list of statements. One line reads that the company "is not an investment company, instead it is a gemstone selling company." Another reads that "USFIA does not sell 'Gemcoin,' rather 'Gemcoin' is being pursued by a separate entity."

However, in marketing materials, the two are directly linked. An online marketing page for GemCoin reads that "the GemCoin is an internal product own by USFIA-USFIA currency."

The same page reads: "The GemCoin was created by USFIA.inc company."

Officials from the California Department of Business Oversight said they were investigating the company in relation to GemCoin.

The department provided KPCC with this emailed statement about one of the claims the company has made:

With respect to their claim that Gemcoin “is the first digital currency legalized by the state of California,” that is misleading at best. The bill they cite to support that claim, AB 129, did not legalize any specific digital currency. What the measure did was repeal a longstanding statute that prohibited the use in commerce of anything other than money issued by the U.S. government.

...In fact, if you read the legislative analyses of AB 129, Gemcoin is not even mentioned as an example of an alternative currency that would be covered by the bill.

Some have called on Wuo to resign. Wuo, who did not respond to an interview request, has attempted to distance himself from the company.

Attorney Liu said endorsement by an elected official is seen as a big deal by many Chinese immigrants. He said at one point, Wuo was misrepresented as a "congressman."

"People from China have a different mentality," Liu said. "In China, if a congressman would endorse a business, it would mean not only is the business legitimate, it s very, very profitable."

Liu is also representing plaintiffs in a lawsuit against another business, Luca International Group, LLC. The Texas-based investment firm, which had a San Gabriel office, collected investments for oil exploration. It was also sanctioned by the government to collect money from EB-5 immigrant investors, who for a minimum investment of $500,000 in a U.S. business may obtain conditional legal immigrant status.

According to a recent complaint filed by the U.S. Securities and Exchange Commission, Luca International principals defrauded investors, using money they obtained for personal expenses; one principal allegedly spent it on a luxury home.

Liu said businesses like these prey on recent Chinese immigrants, who are vulnerable to scams. Unfamiliar with the language and the system, they trust in word-of-mouth references from other members of the community.

Also, "they think 'This is America, this is a society of order, this is a society of law – there are no shysters in America,'" Liu said.

US Fine Investment Arts shares an address in Arcadia with a couple of related entities, including one that calls itself the "US-China Consultation Association."

In his office this week, Liu pointed to a flier in Mandarin from "US-China Consultation Association" offering EB-5 immigrant visa opportunities. Neither entity is listed on a federal list of companies authorized to collect EB-5 investors' money.

The emailed statement from US Fine Investment Arts reads that "USFIA is not offering EB-5 visas."

But earlier this week on the telephone prompt system at one number listed for the company, a woman's recorded voice said, "For details on our EB-5 program, press two."