This story is free to read because readers choose to support LAist. If you find value in independent local reporting, make a donation to power our newsroom today.

This archival content was originally written for and published on KPCC.org. Keep in mind that links and images may no longer work — and references may be outdated.

LA has least affordable housing in US, UCLA study says

UCLA researchers say Los Angeles County is the least affordable place in the country to buy a home.

Rising housing costs coupled with stagnant incomes have given rise to the lowest home ownership rates of any major metropolitan area, according to the new study from UCLA’s Luskin School of Public Affairs.

The study’s co-author Paul Ong said the problem is compounded by a widening income gap between the area’s richest and poorest residents.

“The ones on the bottom have a hard time paying for housing,” said Ong, a professor of urban planning, social welfare and Asian-American studies. “At the same time, the more affluent segment drives the housing market and housing development.”

Ong stressed though that L.A. County is not the most expensive housing market in the U.S. In California, the Bay Area takes the title: The median home value in the San Jose area was $639,100 in 2013 compared to $410,500 for L.A. County.

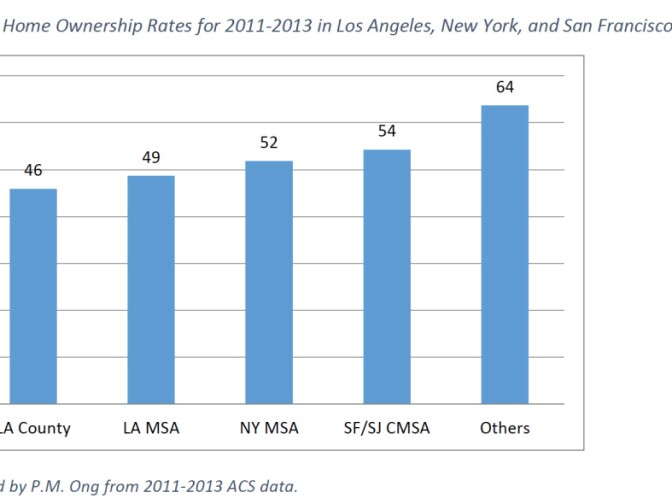

Despite the pricier real estate, the Bay area still has a larger percentage of home owners: 54 percent to LA County’s 46 percent.

“Even if you have higher prices like in the Bay Area, it’s offset and compensated by higher income there,” Ong said.

Both California markets lag the national homeownership rate of 65 percent.

Ong said there is a strong relationship between the rental crisis in L.A. County and its low homeownership rates. An earlier UCLA study found that the average renter in the L.A. area devotes 47 percent of his or her paycheck toward housing.

“If you have high rents, and high rent burdens, it makes it hard for people to accumulate the savings to become homeowners,” Ong said.

Ong said that the high cost of housing has negative implications for both individuals and the region.

The more money people pay towards housing, “it just means we have less money to build up wealth and assets for retirement and education,” Ong said.

Ong added that the region will have a more difficult time recruiting talent to the region because of the high cost of living.

“You can’t have a robust economy and high wage economy without being able to attract the labor you need,” Ong said.

Ong said that he sees the problem on his own campus: UCLA sometimes struggles to sign young faculty because they worry about being able to buy a home.

https://www.scribd.com/doc/273756781/Ong-WideningDivide-Homeownership-8-5-15-1-pdf

What obstacles are getting in the way of your finding a home? Tell us about it here.